5 Finance resources for people who hate math

Do you hate math? We get it. But at the same time, it’s really important to understand the basics of finance, so you can manage your money effectively. Here are our favorite—and painless even for those of us who aren’t math geniuses—5 finance resources to help boost your knowledge about things like budgeting, saving, and …

What’s a secured credit card?

Looking to build your credit but struggling to get approved for a traditional credit card? A secured credit card may be the solution.

5 questions to ask yourself before you buy now pay later

It happens more and more often these days—you’re shopping online and you see an option at checkout for ‘Pay over time’, ‘Pay in 4’, or ‘Pay flexibly’ buy now pay later (BNPL) programs. Sometimes it’s for a higher-priced item, like a refrigerator or a computer. Other times it’s for something inexpensive, like a $30-$40 pair …

Top 5 unexpected expenses to be prepared for

When we make budgets, we plan for all the expenses we know we’ll have to pay for. But what about the things that aren’t routine, those surprise costs that can hit us hard? Here are 5 common unexpected expenses to be prepared for. 1. Car repairs Whether you have a vintage car or a more …

5 ways to make summer camp affordable

Summer camp is a wonderful experience for kids—it’s an opportunity for kids to learn new skills, make friends, and learn to be a little more independent by sleeping away from home for a week or two. It can also be a good chance for parents to get a little break from the day-to-day family routine, …

3 questions to ask before you file an insurance claim

Insurance can be a great safety net to protect you from paying large amounts of money if your home or car is damaged or broken into. In some cases—like when another driver hits you and it’s clearly their fault—the other party’s insurance covers all costs, and your insurance rates typically aren’t affected. Or if you …

5 student loan hacks to pay it off faster

Student loan payments can seem like they’ll be hanging over your head forever, and it’s easy to just accept them as a long-term part of your life. But there are some things you can do to pay them off faster and be out from under them sooner than you think. Imagine how nice it would …

10 Can’t miss freebies to score on your birthday

You say it’s your birthday… well, it probably isn’t today. But when it is, there are some great birthday freebies you should be sure not to miss. Most of these, unfortunately, are only offered on your birthday. And they’re not exactly health food. So pace yourself, but enjoy! They say there’s no free lunch… but …

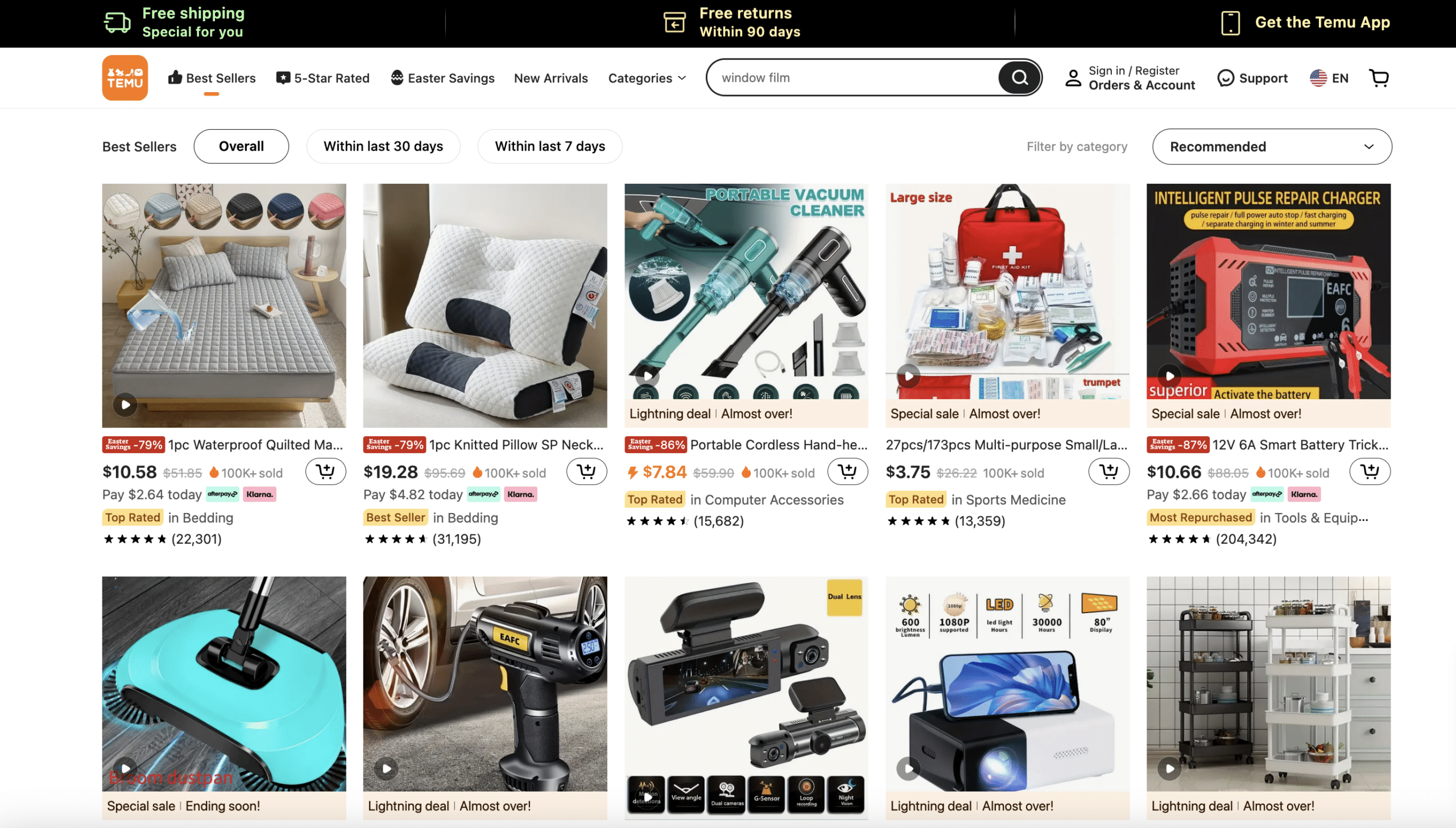

Is Temu Safe? 5 things to know

You’ve probably heard of Temu, the new app-based marketplace. You may have rolled your eyes at its tagline telling you to ‘shop like a billionaire’. You also may have seen its Super Bowl commercials, and been surprised to see them airing alongside established and well-known brands. And sometimes you might read or hear things that …

Does refinancing a car hurt your credit? The pros and cons of refinancing your vehicle

Refinancing your car can help you save money on interest payments, but does it hurt your credit? We’ve got the answers.

Class action settlements: are they worth your time?

Have you ever gotten an email or a card in the email telling you that you might be entitled to compensation from a particular company as part of a class action settlement? It could be an electronics manufacturer, an internet service provider, a car company, or basically any other business that you may have interacted …

How to save on gas: don’t let your budget run on empty

Gas prices are constantly fluctuating, but the overall trend seems to always be upward. As the costs of gas—and everything—keep rising, learning how to save on gas has become increasingly important for drivers. Fortunately, there are some simple ways to improve your fuel efficiency and lower your gas costs. Here are some tips to help …